57+ what factors directly affect an adjustable rate mortgage

Economic conditions Many external factors impact the national average mortgage rates which in turn affect the rate you are charged. Risk is one of the primary factors that affect your mortgage rate.

Pdf Affect And The Gendered Map Of Economic Growth Dragos Simandan Academia Edu

Your credit score is one factor that can affect your interest rate.

. Web Real Estate Market Conditions. Hot economies drive up demand since more people have jobs and money to spend. Web What factors affect an adjustable rate mortgage.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Because of the frequent fluctuations people often lock in an. Web Here are seven key factors that affect your interest rate that you should know 1.

30-year terms will cost you less in loan cost but more in interest whereas a 15-year term will cost you less in interest. Manuel is selling his home to Selena. The temperature of the housing market is another important factor that influences home mortgage rates.

Web The loan term can also significantly affect your mortgage rate. Web Borrowers with larger down payments and higher credit scores are most likely to select a conventional mortgage. Web Mortgage rates are tied to the basic rules of supply and demand.

Indexes that affect ARMs. When more people buy homes there is a higher demand for mortgages which drives up rates. Typically the shorter the term the lower.

Web When demand is flat or falls lenders may adjust their pricing to attract business and keep the lights on. Web Here are 5 factors that affect mortgage interest rates. Web Multiple economic conditions affect the market rate for mortgages and the rate is constantly changing.

Web Mortgage loans that exceed the conforming limit called Jumbo Loans will have a higher interest rate. Supply and demand inflation economic growth the. You are wondering about the question what factors directly affect an adjustable rate.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. He has an existing loan. Web Two factors that will affect your payment during the adjustable-rate period are indexes and caps.

Common options include 10- 15- 20- and 30-year fixed terms. Short-term rates like those for ARMs. Web TOP 10 what factors directly affect an adjustable rate mortgage BEST and NEWEST.

They include the yield on. Banking and lending are risky businesses because theres always a chance the borrower. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

A weak market is usually. Ad Calculate Your Payment with 0 Down. Web When you get a mortgage you select a repayment term.

Save Time Money. Down payment factors that can affect your mortgage rate.

Pdf Funding Self Sustaining Development The Role Of Aid Fdi And Government In Economic Success

Cio Magazine May 2012 Issue By Sreekanth Sastry Issuu

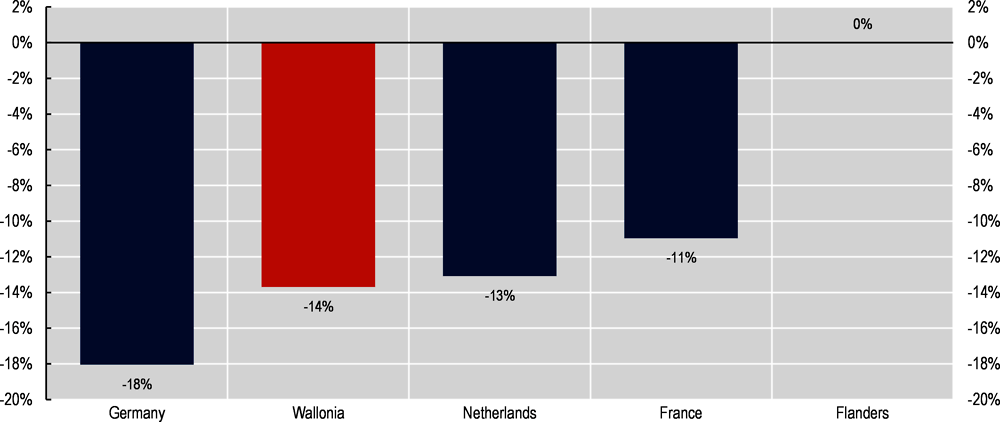

The Role Of Policy And Institutions The Future For Low Educated Workers In Belgium Oecd Ilibrary

Why Home Buyers Should Consider Adjustable Rate Mortgages Wsj

Borrower Guide To Adjustable Rate Mortgages

Q2 Fy22 Results Earnings Announcement

Full Article Chapter Four Europe

Adjustable Rate Mortgage Activity Increases Eye On Housing

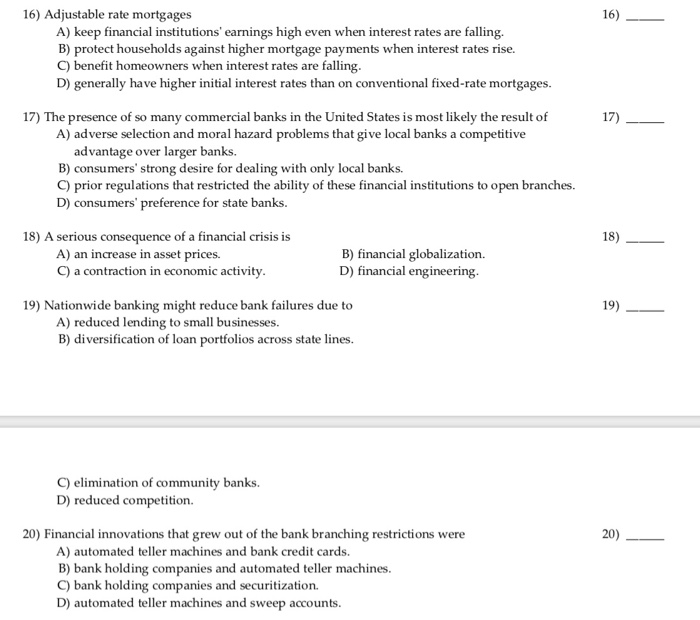

Solved 16 Adjustable Rate Mortgages A Keep Financial Chegg Com

Fha Adjustable Rate Mortgage Arm Guidelines From New Handbook

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Client Q A What S The Difference Between An Adjustable Rate Mortgage Arm And A Fixed Rate Mortgage Frm

Riassunti Corporate Finance Sintesi Del Corso Di Finanza Aziendale Docsity

The Role Of Policy And Institutions The Future For Low Educated Workers In Belgium Oecd Ilibrary

Ethereum For The Next Billion Who Are Your Next Billion Devcon Archive Ethereum Developer Conference

Solvency Of Insurance Undertakings Mueller Report Eiopa

Why Home Buyers Should Consider Adjustable Rate Mortgages Wsj